By: Tracy Augustyniak, Client Manager

“Heads or tails?” That’s what goes through my mind when I think about the Federal Independent Dispute Resolution (IDR) Process. The IDR is the process in which an arbitrator decides certain disputes between payors and providers that qualify as out-of-network (OON) surprise billing situations under the No Surprises Act.

The Act requires commercial payors to reimburse for OON emergency services in some qualifying instances, similar to if the services had been performed by an in-network provider. It also prevents providers from balance billing patients. Instead, providers are required to dispute payments with the applicable health plan if the two sides can’t mutually agree on a fair OON rate.

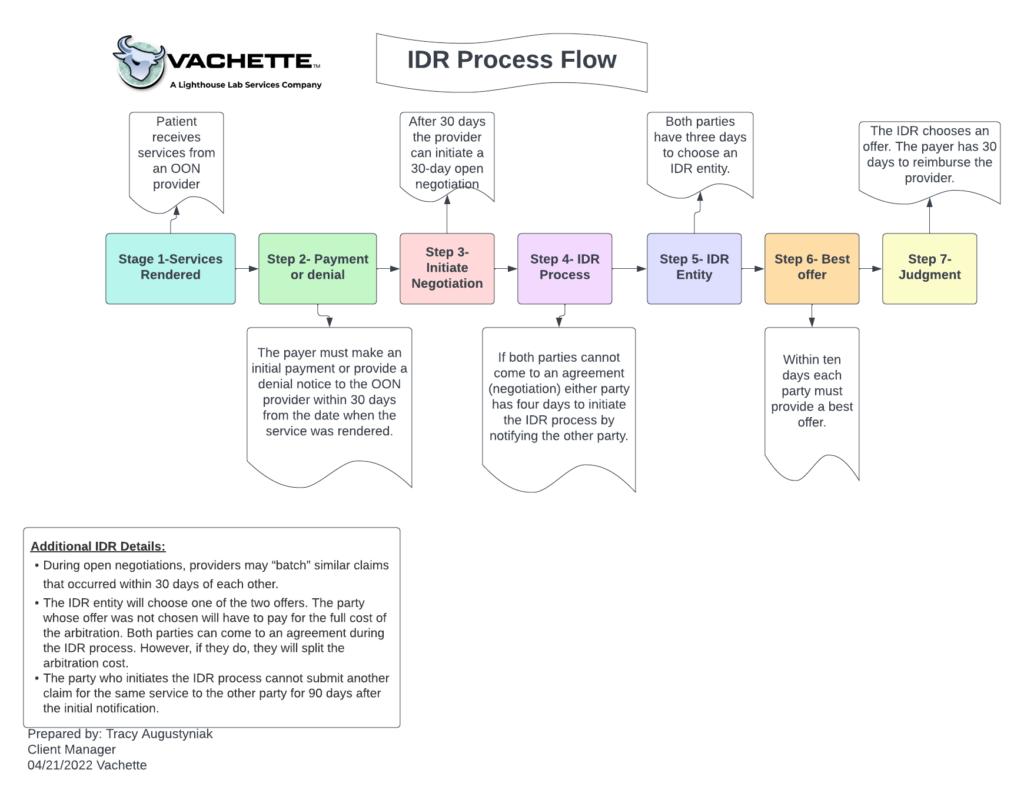

The IDR process involves “baseball-style” arbitration, meaning each party brings one offer of a single payment amount to resolve the dispute. The arbitrator then determines the fairest offer, with no option to split the difference or negotiate further. The process is relatively simple:

- Patient receives services from an OON provider.

- The payor will either send an initial payment or a denial within 30 days of the services rendered.

- After 30 days, the provider can initiate a 30-day open negotiation.

- If after 30 days both parties cannot come to an agreement, either party has four days to initiate the IDR process by notifying the other party.

- Both parties have three days to choose an IDR entity.

- Within ten days each party must submit their best offer.

- The IDR chooses an offer, and the payor will have 30 days to reimburse the provider.

Determining an appropriate payment

Arbiters are instructed by statute and the final rule to consider several factors, such as the level of training, experience, quality, and outcomes of the provider; the market share held by the provider and/or the plan; patient acuity; and teaching status, case mix, and scope of services of the provider. However, the rule clearly states the qualified payment amount (QPA) is to be deemed the most key factor to determine the OON rate in the payment dispute.

The QPA will be a “payor’s median in-network rate for (a) the same or similar services, (b) furnished in the same or a similar facility, (c) by a provider of the same or similar specialty, (d) in the same or similar geographic area. Calculation of the median rate will be based on payors’ rates as of January 31, 2019, adjusted for inflation going forward,” according to CMS. The QPA is just the starting point for the IDR determination of the out-of-network payment amount.

As with anything, there are fees associated with the IDR process. Both parties must pay an administrative fee of $50 at the time the IDR entity is selected. The administrative fee is established annually in a manner so that the total administrative fees collected for a year are estimated to be equal to the number of expenditures estimated to be made by the departments. The party that “loses” the arbitration is responsible for paying the arbitration fee.

You can find additional information such as available IDR entities and their fees by visiting: List of certified organizations | CMS

Next steps

The Federal Independent Dispute Resolution (IDR) Process under the No Surprises Act is an additional challenge facing physicians and other healthcare providers since it was implemented earlier this year. Whether attempting to navigate a surprise billing dispute or everyday reimbursement issues, Lighthouse Lab Services and our RCM affiliate Vachette can offer assistance and negotiations strategies to ensure you receive fair reimbursement for your services. We will continue to monitor the IDR process and provide updates amid the legal challenges the law is currently facing from several healthcare advocacy organizations.

Contact us today for a free consultation if you’re seeking assistance navigating these issues.

And remember, should you choose arbitration, “May the odds be ever in your favor.”

References:

Acep.org. n.d. Independent Dispute Resolution: The Best Federal Solution to Protect Patients from Surprise Billing. [online] Available at: <https://www.acep.org/globalassets/sites/acep/media/advocacy/federal-advocacy-pdfs/acep-idr-facts.pdf> [Accessed 25 April 2022].

American Hospital Association. 2021. Agencies Issue ‘Part Two’ of Regulations Banning Surprise Medical Bills | AHA. [online] Available at: <https://www.aha.org/special-bulletin/2021-10-01-agencies-issue-part-two-regulations-banning-surprise-medical-bills> [Accessed 28 April 2022].

Qualls, G., 2021. Agencies Propose Rules to Implement No Surprises Act Federal IDR Process. [online] The National Law Review. Available at: <https://www.natlawreview.com/article/agencies-propose-rules-to-implement-no-surprises-act-federal-idr-process> [Accessed 25 April 2022].