While the legal intent of the Eliminating Kickbacks in Recovery Act (EKRA) overlaps in several areas with existing Anti-Kickback Statute (AKS), EKRA is separate offense with some substantial distinctions that serve to make the law more stringent for laboratories than AKS.

Chief among these differences is that EKRA covers all referrals to recovery homes, clinical treatment facilities or laboratories. This holds true whether or not the referred service is related to treatment for substance abuse. It’s also important to note the definition of “laboratories” under EKRA is extremely broad and also includes physician-owned laboratory arrangements. These entities were specifically targeted with the intent of addressing the opioid crisis and ending the practice of “patient brokering”.

EKRA also differs from AKS in that it applies to all payers, whereas AKS only applies to federal health care programs. The intent of this key distinction allows the federal government to monitor payment arrangements related to items and services that are reimbursed by private health plans with the hope of further dissuading bad actors.

Navigating Restrictions to Employee Compensation

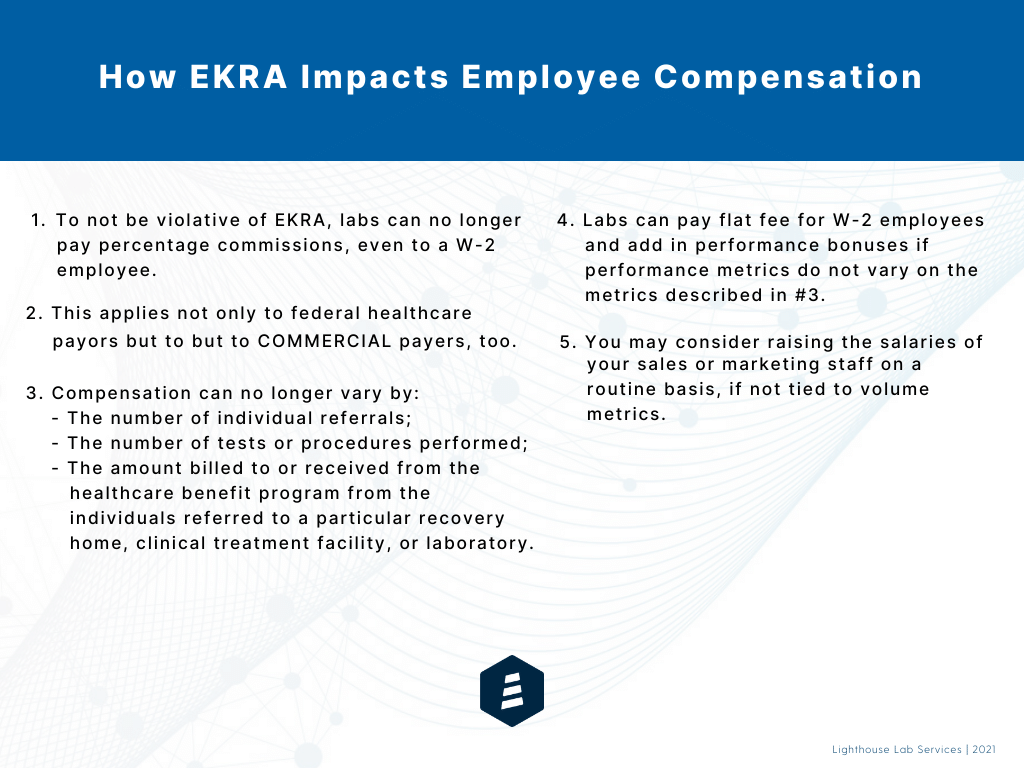

Because EKRA’s bona fide employee safe harbor does not permit compensation that is determined by, or varies with, the number of individuals referred, the number of tests or procedures performed, or the amount billed to or received from a payer, pre-existing employee compensation arrangements that comply with the Anti-Kickback Statute may now run afoul of EKRA.

So, what does this mean in a nutshell for your compensation arrangements, particularly those of sales or marketing employees who traditionally may have had payment tied to various volume-based metrics? The graphic below explains the restrictions in detail and offers a few alternative compensation tips:

Other EKRA Safe Harbors

However, there are additional exceptions to EKRA’s restrictions. Similar to the Anti-Kickback Statute safe harbors, EKRA allows for eight statutory “safe harbors”:

- Personal service and management contracts

-

- Payment made by “a principal to an agent as compensation for the services of the agent under a personal services and management contract” under section 1001.952(d) of title 42 of the Code of Federal Regulations (“C.F.R.”),11 “as in effect on the date of enactment of this section”

- Medicare coverage gap discounts

- Discount in the price of an applicable manufacturer’s drug that is furnished to an applicable beneficiary under the Medicare coverage gap discount program

- Federally qualified health center

- Transfer of goods, items, services, donations, or loans set out in writing that are medical or clinical in nature and contribute meaningfully to the health center’s ability (among other requirements) to serve a medically underserved population

- Coinsurance waiver/discount

- If (1) not routinely provided and (2) provided in good faith (similar to AKS exception 42 C.F.R. 1001.952(k)14 and civil monetary penalty exception 42 U.S.C. 1320a–7a(i)(6)

- Standard discount

- Reduction in price if “properly disclosed and appropriately reflected in the costs claimed or charges made by the provider or entity”

- Employee and independent contractor compensation

- Bona fide employment or a contractual relationship with such employer; payment not determined/varied by the (1) number of individuals referred to the facility, (2) number of tests/procedures performed, or (3) amount billed to the health care benefit program (all payors)

- Alternative Payment Models

- Remuneration made pursuant to (1) an alternative payment model or (2) a payment arrangement deemed necessary by the Secretary of the U.S. Department of Health and Human Services (“HHS”) for “care coordination or value-based care”

- Other exceptions, as determined by discretion of HHS

Remember, those found to be in violation of EKRA may be subject to up to 10 years in prison and up to a $200,000 fine, per violation, so now is the time to ensure your compensation arrangements are meeting this new standard if you have not done so already. While the Covid-19 Public Health Emergency slowed federal enforcement in several areas of concern for fraud and abuse, there have already been a handful of Covid-related prosecutions under EKRA and it wouldn’t be surprising to see enforcement under the act ramp up in the near future.